philadelphia wage tax rate

Be certain your payroll systems are updated to reflect the increased non-resident tax rate. Everyone who lives in Philadelphia is subject to the City Wage Tax regardless of where they work.

2021 Pennsylvania Payroll Tax Rates Abacus Payroll

The City of Philadelphia wage tax is a tax on salaries wages commissions and other compensation paid to an employee who is employed by or renders services to an employer.

. Census Bureau Number of municipalities and school districts that have local income taxes. The City of Philadelphia is decreasing its Wage Tax and Earnings Tax rates for resident and non-resident taxpayers as of July 1 2021. In addition non-residents who work in Philadelphia are required to pay the Wage Tax.

News release City of Philadelphia June 30 2020 Similarly the Philadelphia nonresident Earnings Tax and Net Profits Tax NPT. For non-residents the Wage Tax applies to compensation for work or services. For residents and 344 for non-residents.

Wage and Earnings taxes. The rate for residents will be 38398 percent as of July 1 2021 while the rate for non-residents will be 34481 percent as of July 1 2021. What this means for you.

Here are the new rates. Everyone who lives in Philadelphia is subject to the City Wage Tax regardless of where they work. The wage tax rate for residents of Philadelphia was not increased and remains at 38712 038712.

Here are the new rates. The Earnings Tax rate for residents is also decreasing from 38712 to 38398. SIT rates for residents have been increased to 38712 percent for.

This change must be in place for all. The Philadelphia Net Profits Tax NPT which is imposed on the net profits from the operations of a trade business profession enterprise of other activity. Starting on July 1 the.

It is just a 0008 decrease in wage tax. What is Philadelphia city wage tax 2019. Nonresident Earnings Tax rates will be reduced to 34481 percent down from the previous rate of 35019 percent and resident Earnings Tax rates will be.

See below to determine your filing frequency. The City of Philadelphia announced that effective July 1 2020 the Wage Tax rate for nonresidents is 35019 an increase from the previous rate of 34481. In 1939 Philadelphia became the first city nationwide to implement a wage tax at a rate of 15 percent.

Based on the average median household income in Philadelphia of around 49k thats a savings of about 47 cents per week. In addition non-residents who work in Philadelphia are required to pay the Wage Tax. The rate for residents will be 38398 percent as of July 1 2021 while the rate for non-residents will be 34481 percent as of July 1 2021.

The Earnings Tax rates in the new fiscal year are therefore 38712 038712 for residents and 35019 035019 for non-residents. It also lowered the Business Income and Receipts Tax BIRT tax from 62 to 599. The tax was made possible by the Sterling Act a Depression-era state law that allowed the city to earn revenue by passing special taxes.

The new Wage Tax rate for residents of Philadelphia is 379 0379. Employers collect the Wage Tax from a workers paycheck and remit it to the. Earnings Tax employees Due date.

But for the 2023 fiscal year the City of Philadelphia is reducing that tax rate to the lowest its been in five decades. Do I have to include Philadelphia City Wage Tax on my New Jersey tax return. The rate for residents will be 38398 percent as of July 1 2021 while the rate for non-residents will be 34481 percent as of July 1 2021.

On Thursday Philadelphia City Council voted to reduce wage taxes to 379 from 387 for residents and 344 from 345 for non-residents. Effective July 1 2022 the Philadelphia City Wage Tax will decrease for both residents and non-residents. Pennsylvania income tax rate.

For residents of Philadelphia or 344 for non-residents. The wage tax grew over time reaching its highest rate of 496 percent for residents in 1985. The nonresident Earnings Tax rates in Philadelphia Pennsylvania will be reduced starting on July 1 2021.

The new NPT and SIT rates are applicable to income earned in Tax Year 2022 for returns due and taxes owed in 2023. The new Wage Tax rate for residents is 38398. All Philadelphia residents owe the City Wage Tax regardless of where they work.

The main difference is how the tax is collected and paid to the City of Philadelphia. 2022-2023 Philadelphia City Wage Tax Rate. The rate as of July 1 2019 for residents of Philadelphia decreases from 38809 to 38712 and the rate for nonresidents of Philadelphia decreases from 34567 to 34481.

The rate for residents remains unchanged at 38712. For specific deadlines see important dates below. 344 0344 The non-resident City Wage Tax applies to those employed by a Philadelphia-based entity.

For non-residents the savings are even more minuscule. Changes to the Wage and Earnings tax rates become effective July 1 2022. From now on you can complete online returns and payments for this tax on the Philadelphia Tax Center.

The new BIRT income tax rate becomes effective for tax year 2023 for returns due and taxes owed in 2024. Everyone who lives in Philadelphia is subject to the City Wage Tax regardless of where they work. 379 0379 Wage Tax for Non-residents of Philadelphia.

The City of Philadelphia announced that effective July 1 2021 the Earnings Tax rate for nonresidents is 34481 down from 35019 and the rate for residents is 38398 a decrease from the previous rate of 38712. The new Wage Tax rate for residents is 38398. Effective July 1 2021 the rate for residents is 38398 percent and the rate for non-residents is 34481 percent.

The July 1 st city wage tax increase will take effect the same week that Philadelphia moves into the green phase for businesses to reopen. The Earnings Tax rate for residents is also decreasing from 38712 to 38398. Any paycheck that you issue with a pay date after June 30 2022 must have Philadelphia City Wage Tax withheld at the new rate for residents.

The new NPT rates for calendar year 2019 are 38712 percent 038712 for residents and 34481 percent 034481 for non-residents respectively. The Earnings Tax closely resembles the Wage Tax. The City of Philadelphia is decreasing its Wage Tax and Earnings Tax rates for resident and non-resident taxpayers as of July 1 2021.

The wage tax rate is set to drop from 384 to 379 for resident city workers. 307 Median household income. The new Wage Tax rate for non-residents who are subject to the Philadelphia City Wage Tax is 344 0 344.

Quarterly plus an annual reconciliation. The Wage Tax must be filed quarterly and paid on a schedule that corresponds with how much money is withheld from employees paychecks. Wage Tax for Residents of Philadelphia.

In addition non-residents who work in Philadelphia are required to pay the Wage Tax. Non-residents who work in Philadelphia must also pay the Wage Tax.

Philly City Council Reaches Budget Deal With Tax Relief Whyy

Philadelphia Wage Tax Decreases On July 1 Department Of Revenue City Of Philadelphia

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Philadelphia Looks To Reduce City Wage Tax To Offset Rising Property Tax Burden Philadelphia Business Journal

Philadelphia Wage Tax Cut What Does It Mean For Workers On Top Of Philly News

Approval Of Business And Wage Tax Cuts Hailed As Turning Point By Philadelphia Business Leaders Philadelphia Business Journal

Philly Budget Wage Tax Shrinks Anti Violence Spending Up Whyy

City Of Philadelphia Announces Wage Tax Rate Increase For Non Residents Starting July 1 2020 Wouch Maloney Cpas Business Advisors

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

2020 Philadelphia Tax Rates Due Dates And Filing Tips

Philly Announces New Tax Rates For Wage Earnings And Other Taxes Department Of Revenue City Of Philadelphia

Philadelphia Wage Tax For Non Residents Increases On July 1 Department Of Revenue City Of Philadelphia

Philadelphia City Council Approves Business And Wage Tax Cuts In 5 6b Budget Deal Philadelphia Business Journal

Philadelphia City Council Approves Business Wage Tax Cuts In 5 6b Budget Deal Nbc10 Philadelphia

Pennsylvania Rules On Philly Wage Tax Credit Case Grant Thornton

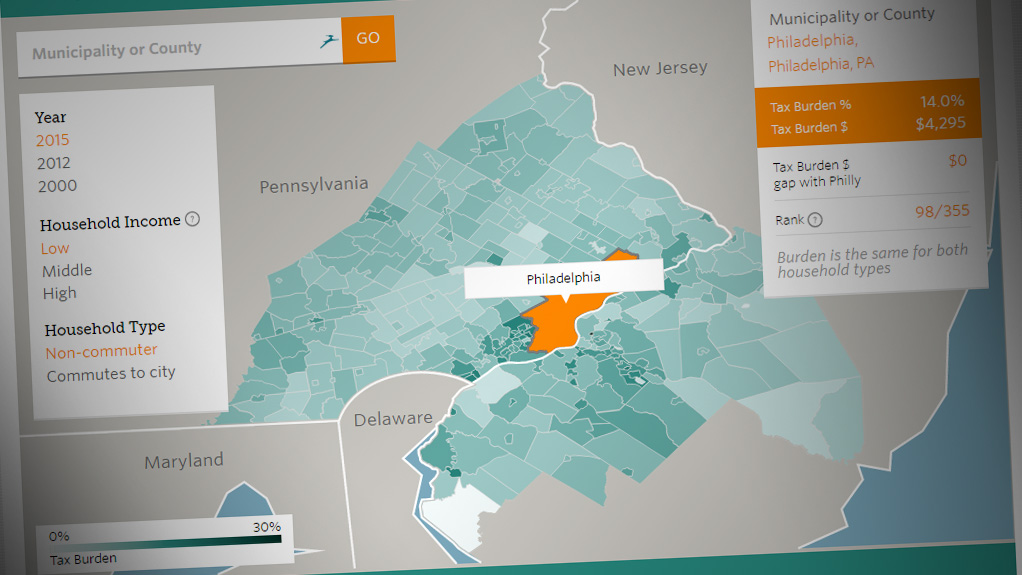

Comparing The Tax Burden In Philadelphia And The Suburbs The Pew Charitable Trusts